All Categories

Featured

Table of Contents

This starting number shows the tax obligations, charges, and rate of interest due. After that, the bidding starts, and several capitalists increase the rate. Then, you win with a quote of $50,000. The $40,000 increase over the original bid is the tax obligation sale overage. Asserting tax obligation sale excess implies getting the excess money paid throughout an auction.

That said, tax sale overage cases have shared characteristics across most states. During this period, previous owners and home mortgage holders can get in touch with the county and receive the excess.

If the duration runs out prior to any type of interested parties declare the tax obligation sale overage, the region or state usually absorbs the funds. When the cash mosts likely to the federal government, the opportunity of asserting it vanishes. Therefore, previous proprietors are on a rigorous timeline to claim overages on their residential or commercial properties. While excess usually do not correspond to higher earnings, financiers can capitalize on them in several means.

, you'll earn passion on your entire bid. While this aspect doesn't imply you can declare the overage, it does assist alleviate your expenditures when you bid high.

High-Performance Tax Overages Business Guide Tax And Mortgage Overages

Remember, it may not be legal in your state, meaning you're limited to gathering interest on the overage. As specified above, a financier can locate means to benefit from tax obligation sale overages. Tax Sale Overage Recovery. Because interest revenue can put on your entire bid and previous owners can assert excess, you can utilize your knowledge and devices in these circumstances to optimize returns

A critical facet to keep in mind with tax obligation sale excess is that in many states, you just need to pay the region 20% of your complete bid up front., have regulations that go beyond this guideline, so once again, research your state regulations.

Rather, you only need 20% of the proposal. Nevertheless, if the property does not retrieve at the end of the redemption duration, you'll need the staying 80% to get the tax obligation act. Since you pay 20% of your quote, you can make interest on an overage without paying the complete rate.

Renowned Best States For Tax Overages Course Foreclosure Overages List

Again, if it's lawful in your state and region, you can deal with them to aid them recuperate overage funds for an extra fee. You can accumulate interest on an overage bid and bill a charge to simplify the overage insurance claim procedure for the past owner. Tax Sale Resources lately launched a tax sale excess product specifically for individuals thinking about pursuing the overage collection company.

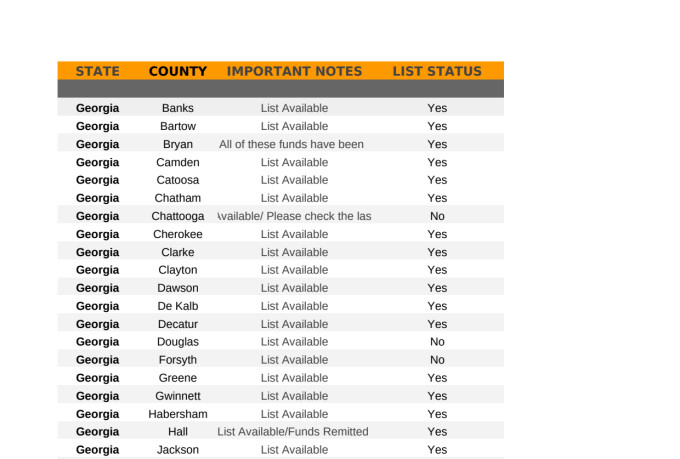

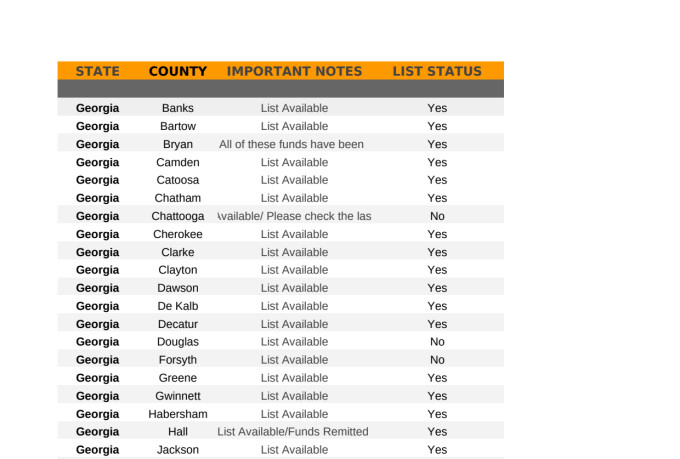

Overage collectors can filter by state, area, residential or commercial property type, minimal overage quantity, and optimum excess amount. When the information has actually been filteringed system the collectors can determine if they want to add the skip mapped information bundle to their leads, and after that spend for only the validated leads that were found.

In enhancement, simply like any kind of other investment approach, it provides special pros and cons.

Best-In-Class Tax Sale Overage List Training Mortgage Foreclosure Overages

Or else, you'll be prone to unseen threats and legal ramifications. Tax sale excess can create the basis of your investment version because they give a low-cost means to generate income. You don't have to bid on homes at public auction to spend in tax obligation sale excess. Instead, you can investigate existing overages and the previous proprietors that have a right to the cash.

Doing so doesn't cost numerous thousands of bucks like acquiring several tax liens would certainly. Instead, your research study, which might involve avoid tracing, would cost a relatively small fee. Any state with an overbid or exceptional proposal technique for auctions will have tax obligation sale overage opportunities for capitalists. Bear in mind, some state laws prevent overage choices for previous owners, and this issue is really the topic of a current High court instance.

Comprehensive Bob Diamond Overages Learning Tax Auction Overages

Your resources and method will identify the best setting for tax overage investing. That said, one approach to take is accumulating interest above costs. Therefore, capitalists can acquire tax sale excess in Florida, Georgia, and Texas to make use of the costs proposal legislations in those states.

Any type of public auction or repossession involving excess funds is a financial investment chance. You can spend hours researching the past owner of a property with excess funds and contact them just to discover that they aren't interested in pursuing the cash.

You can start a tax obligation overage service with minimal expenses by finding info on recent homes sold for a costs proposal. Then, you can get in touch with the previous proprietor of the residential property and offer a price for your solutions to help them recuperate the excess. In this scenario, the only cost entailed is the research study as opposed to costs tens or hundreds of countless dollars on tax obligation liens and acts.

These overages generally create passion and are offered for past proprietors to case - Overages Surplus Funds. As a result, whether you buy tax obligation liens or are exclusively interested in cases, tax sale overages are investment opportunities that call for hustle and strong research to make a profit.

Unparalleled Foreclosure Overages Learning Bob Diamond Overages

A party of interest in the home that was cost tax obligation sale may assign (transfer or sell) his or her right to claim excess profits to somebody else only with a dated, written paper that explicitly states that the right to declare excess profits is being assigned, and just after each event to the suggested job has actually revealed to each various other celebration all truths connecting to the value of the right that is being assigned.

Tax sale overages, the excess funds that result when a home is offered at a tax sale for greater than the owed back taxes, charges, and prices of sale, stand for a tantalizing opportunity for the initial homeowner or their successors to recover some value from their lost property. The procedure of declaring these overages can be complicated, bogged down in lawful treatments, and differ considerably from one territory to another.

When a residential or commercial property is cost a tax obligation sale, the primary objective is to recuperate the overdue residential property taxes. Anything over the owed quantity, consisting of fines and the price of the sale, ends up being an excess - Tax Overages List. This overage is essentially cash that ought to rightfully be returned to the former homeowner, presuming nothing else liens or claims on the building take priority

Table of Contents

Latest Posts

Forfeited Taxes

List Of Tax Properties For Sale

Homes Lost To Taxes

More

Latest Posts

Forfeited Taxes

List Of Tax Properties For Sale

Homes Lost To Taxes