All Categories

Featured

Table of Contents

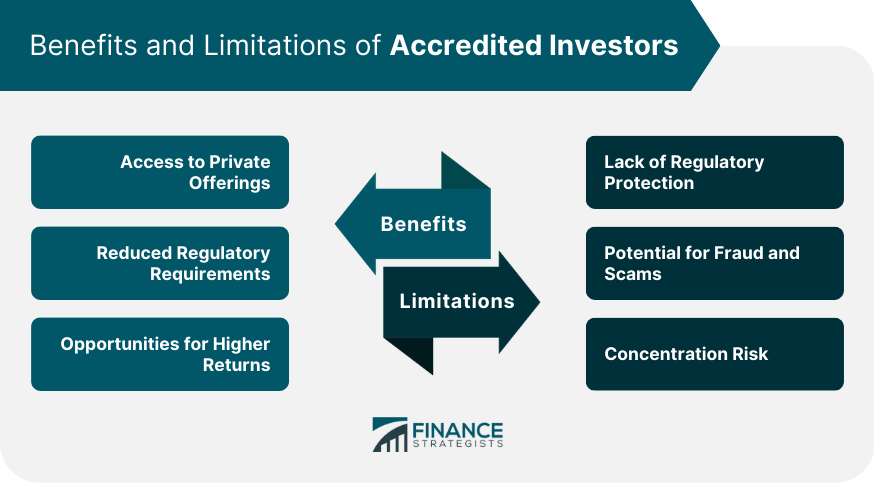

With accredited investor requirements, capitalists are avoided from spending past their ways. If a bad financial investment choice is made, theoretically a certified capitalist has better monetary means to soak up the losses. Furthermore, unregistered personal protections might have liquidity restrictions; such safeties may not have the ability to be marketed for an amount of time.

Financiers should represent their financial resources honestly to issuers of safeties. If an investor claims they are an accredited investor when they aren't, the monetary business can reject to sell protections to them. Understanding what certifies an investor as certified is vital for determining what types of protections you can buy.

Advanced Accredited Investor Alternative Investment Deals

The needs likewise promote technology and progression via added financial investment. Despite being approved, all investors still require to do their due persistance during the procedure of investing. 1031 Crowdfunding is a leading property investment system - accredited investor investment funds for alternate investment automobiles largely available to recognized investors. Certified capitalists can access our selection of vetted investment opportunities.

With over $1.1 billion in safeties marketed, the management team at 1031 Crowdfunding has experience with a broad variety of financial investment frameworks. To access our full offerings, register for a financier account.

PeerStreet's objective is to level the having fun field and permit individuals to access genuine estate debt as an asset class. Due to governing demands, we are needed to follow the SEC's policies and enable just accredited financiers on our system. To much better enlighten our investors concerning what this implies and why, read listed below to find out about these federal legislations.

Recognized financiers and recognized investor platforms are considered as much more innovative, efficient in taking on the threat that some safeties offer. This guideline also relates to entities, that include, financial institutions, collaborations, companies, nonprofits and trusts. PeerStreet is thought about a "private placement" financial investment possibility, unlike federal government bonds, and therefore based on a little different federal policies.

Trusted Accredited Investor Financial Growth Opportunities for Secured Investments

These regulatory requirements have origins that go far back into the advancement of America's banking sector. The Stocks Act of 1933, only four years after the stock market crash of 1929 and in the thick of the Great Clinical depression, made specific specifications concerning just how securities are marketed.

If you're wanting to construct and diversify your investment portfolio, take into consideration investments from commercial real estate to farmland, red wine or great art - accredited investor wealth-building opportunities. As a certified investor, you have the chance to designate a section of your portfolio to even more speculative possession courses that provide diversity and the potential for high returns

See All 22 Items If you're a certified financier searching for new chances, take into consideration the following varied investment. Yieldstreet focuses on investments in property, legal settlements, art, financial tools and shipping vessels. Yieldstreet is one of the most effective property spending apps for those interested in actual estate and alternative investments that have a high web worth, with offerings for approved and nonaccredited investors.

Masterworks permits capitalists to have fractional shares of fine art. Masterworks gives you the option to expand your portfolio and invest in blue-chip art work while potentially making earnings from 8% to 30% or more.

Expert Accredited Investor Investment Networks

This opportunity comes with all the benefits of other alt investments on the checklist, such as diversifying your profile to secure against securities market volatility. Vinovest has actually revealed earnings of 10% to 13% every year in the past. 10.6% annualized returnsAnnual fees begin at 2.25% Got here Houses offers certified and nonaccredited investors the option to get and sell single-family homeowners and vacation rental residential properties with an ultra-low minimum investment of just $100.

A recognized capitalist has a special status under economic law laws. Each nation defines particular requirements and guidelines to qualify as a recognized capitalist.

Accredited capitalists in the U.S. need to please at the very least one need regarding their net well worth or earnings, asset dimension, governance standing or professional experience. This requirement consists of high-net-worth people (HNWIs), brokers, counts on, banks and insurer. The U.S. Stocks and Exchange Commission (SEC) defines the term recognized investor under Policy D.

The concept of marking recognized investors is that these individuals are thought about financially innovative enough to birth the dangers - accredited investor investment returns. Sellers of non listed securities might just offer to recognized capitalists.

World-Class Accredited Investor Opportunities

A number of investment alternatives for recognized capitalists, from crowdfunding and REITs to difficult cash fundings. Right here's what you can think about. Crowdfunding is an investment chance growing in appeal in which a firm, specific or task looks for to increase necessary resources online.

The duty of the syndicator is to look and safeguard residential properties, handle them, and connect investment agreements or set financiers. This procedure streamlines realty financial investment while offering accredited investors exceptional investment opportunities. REITs swimming pool and look after funds spent in different realty properties or real-estate-related activities such as mortgages.

Table of Contents

Latest Posts

Forfeited Taxes

List Of Tax Properties For Sale

Homes Lost To Taxes

More

Latest Posts

Forfeited Taxes

List Of Tax Properties For Sale

Homes Lost To Taxes